Thursday, February 25, 2010

Market Action

Technical & On Broker’s Notes

AgriNurture (PSE:ANI) – gap filled at 18.50, and have formed a neutral stand on its on consolidating pattern. With base low at 15.75, ANI needs to tackle 19 (15.75 x 1.20 = 18.90) for reversal.

Metro Pacific Investments (PSE:MPI) - heavy support again by CLSA. Big seller JP Morgan is still dumping together with Deutsche.Any cross sales done by these two sellers is favorable to MPI.

IPVG (PSE:IP) – earlier at 1.82, IP registered an RSI readings of 50.60 (considered oversold if RSI is at 50-52but not <>

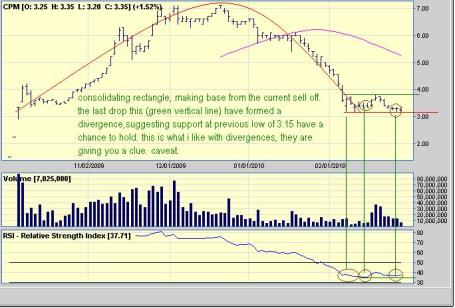

Century Peak Metals (PSE:CPM) – Nice base building.

Labels: century peak metals, cpm. pse cpm, mining company, philippine stock market

Friday, January 29, 2010

Market Action

Note: Updated within the day)

9:44am PAX opened at 2.50, gapping 4 cents from its yesterday’s close at 2.46

9:48am After opening at 68, the stock lost its grip as investors find it to pricey to push IMI to its 5th consecutive limit up of 50% gain for the day. Currently trading to 40 a piece, down 5.50 from yesterday.

10:00am Broker 209 started doing cross sales at SMDC, totalling to 1M shares at 2.50 (4 blocks of 250k shares).

10:30am APC (+0.03, +9.68%) in the attached disclosure dated January 26, 2010, stated among others that: We would like to report that the Board of Directors of APC Group, Inc. (“Company”) in a meeting held today, January 26, 2010, approved the quasi-reorganization of the Company by way of reducing the Company’s par value per share. The reduction in par value will initially result in the reduction of the Company’s negative retained earnings (deficit) approximately by half. The new par value of the Company’s shares and the exact amount of the resulting reduction in deficit will be decided after further study and consideration.

10:40am The Philippine Stock Echange Index (PSEi) have been undecided all day, keeping a narrow range at the 2,900 level.Previous support at 2,950 is now a resistance. Heavy weight Ayala Corp (PSE:AC, +2.50, +0.86%) is adding support to the market.

11:00am SMDC alert. Total 3m shares crossed by broker 209.

11:06amTechnical watch. MRC (+0.01, +1.41%) is within a triangle make or break.resistance at 0.79 & 0.88 (current high) and support pegs at 0.66 & 0.59

11:26am Still Consolidating. Pepsi Philippines (PSE:PIP) remains unchanged at 2.30/share. Buyer is still ATR. I noticed they’re been on defensive buying mode. The stock have shown to be resilient and stayed on the 2.30 level despite the index selldown previously. A break at 2.55 will open gates at 3.50, Pepsi’s IPO price.

11:50am PSEi (+38 pts, +1.31%) going pass the 2,950 initial resistance. The divergence as previously pointed out yesterday proved to be a signal that the index have enough of this emotional tantrums. Psychological resistance points to the 3,000 level. Expect confidence to build up as 2,950 was taken.

11:58amConfirmed. The Famous Father of All Funds, Mark Mobius of Templeton Asset was in Cebu last week. Business or Pleasure? I’m not guessing.

Labels: mrc, pepsi, philippine stock market, phisix, pip, psei

Wednesday, May 06, 2009

On Broker's Analysis - MEGAWORLD (PSE: MEG)

Meg's top buyers

Time & Sales

Cross sales

This is one of the reason why most of my clients who have megaworld shares sold today. early trading we saw a barrage of buying done by foreign brokers. From the way they aggressively bought up the shares, program buying is their theme for today. Filipino traders have a festival on Meg’s occasion today. Unfortunately, this festivity where local traders are making a profit on foreign brokers’ buying and selling are about to end. The Philippine Stock Exchange are about to adapt a rule hiding a broker’s identity in buying and selling. Once implemented, local traders and investors can no longer “monitor” who’s buying and selling. This rule for me is anti-investor and protects only the big foreign houses. There will be massive front running and investors have no protection whatsoever, specially if they “put an open price order” to their brokers’ discretion. Anyway, that’s another story.

Back to Meg. Program buying have huge impact on the intraday activities of a stock price. A magnitude such as this will definitely buoy up the stock. Same is true to program selling. In timing the “ride”, I look for huge crosses to signal that the “program” is nearing completion or have rested. This is the same example i posted on PEPSI’s broker’s analysis and the relevance of crosses. In Meg, CLSA’s activity is definitely program buying. From near mid 0.70s on the way up to 0.80s. After which, made huge crosses at 0.82 and 0.84. For me that’s the signal that the program was done for the day, thus we sell. If it continues on the next day, buying back even at a price higher than our selling price is not a problem with us. We don’t buy price, we buy momentum and patterns and reasons. Same goes as why we sell.

Labels: broker's analysis, cross sale, megaworld, philippine stock market, pse, pse meg, stock market

Saturday, April 25, 2009

Southeast Asia Cement Hldgs, Inc. (PSE: CMT)

Friday, April 24, 2009

First Philippine Holdings (PSE: FPH)

Labels: first philippine holdings, fph, lopez company, lopez stocks, philippine stock market, pse fph, triangle pattern

Wednesday, April 22, 2009

Chart Vault

Labels: aud usd pair, commodities analysis, euro/gbp, euro/usd, forex, gold, gold chart, oil, oil chart, philippine stock market, phisix, pse, psei, stock market, technical analysis, usd/yen

Subscribe to Posts [Atom]